Sustainable investing is a powerful approach that combines financial gains with social responsibility.

By prioritizing environmental and social factors, investors not only seek profit but also contribute to a healthier planet.

Understanding sustainable investing

Understanding sustainable investing is crucial for modern investors. It refers to investing strategies that consider not just financial returns but also the environmental and social impacts of investments. By focusing on companies and projects that promote positive sustainability outcomes, investors can align their portfolios with their values.

What distinguishes this approach from traditional investing is its holistic view. This strategy can help mitigate risks associated with environmental issues, such as climate change and resource depletion. Investors are increasingly aware that companies prioritizing sustainability tend to perform better over time.

Moreover, engaging in these strategies allows individuals to have a voice in the environmental and social changes they wish to see. By choosing where to allocate funds, they can support innovations in renewable energy, social justice, and ethical governance.

In today’s market, various options are available, including mutual funds and exchange-traded funds (ETFs) that specifically focus on sustainability metrics. This growth reflects a shift in investor sentiment toward more responsible investment practices.

Ultimately, understanding these principles enables individuals to make informed decisions that not only seek profit but also contribute to a better world.

Benefits of sustainable investing

The benefits of sustainable investing are numerous and impactful. First, it allows investors to support companies that prioritize environmental stewardship and social responsibility. This alignment with personal values can lead to a greater sense of fulfillment and purpose in one’s investment strategy.

Additionally, this approach opens up opportunities for strong financial performance. Research indicates that firms with robust sustainability practices often outperform their less sustainable peers in the long term. This success is partly due to their ability to adapt to regulatory changes and consumer preferences that increasingly favor sustainable practices.

Moreover, by focusing on environmentally friendly businesses, investors can mitigate risks linked to climate change and resource scarcity. It can serve as a hedge against future risks, enhancing portfolio stability as economies shift toward greener practices, similar to how consolidation loans can help stabilize personal finances.

Lastly, engaging in this type of investing can influence corporate behavior. By directing capital toward sustainable companies, investors can push other firms to adopt better practices, promoting a broader positive impact across industries.

How to start sustainable investing

Starting your journey in sustainable investing is easier than you might think. First, it is important to research and understand what this type of investing entails. This involves identifying companies that focus on environmental sustainability, social responsibility, and ethical governance.

Next, consider your investment goals. Are you looking for long-term growth, or do you want to support specific causes? Knowing your objectives will help guide your choices.

Once you have your goals set, you can explore investment options. Many mutual funds and ETFs specialize in sustainable investments, which can simplify the process. Look for funds that provide clear information about their sustainability criteria and performance.

Additionally, it’s valuable to assess risks. This approach can be less about traditional financial metrics and more about navigating new areas of risk and opportunity. Stay informed about trends in sustainability and be prepared to adjust your strategy as necessary.

Finally, consider connecting with a financial advisor who understands this investing approach. They can help you create a diversified portfolio that aligns with your values and financial goals. By starting your journey with knowledge and intention, you can make a positive impact while pursuing your financial interests.

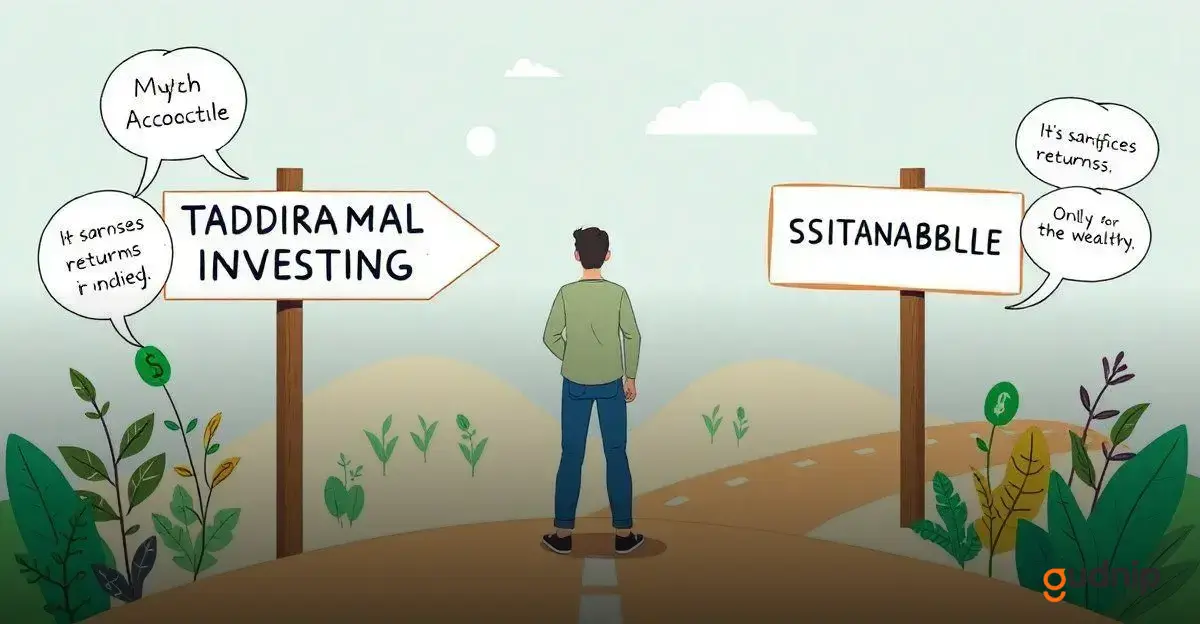

Common myths about sustainable investing

Many people have misconceptions about investing sustainably that can lead to hesitance in adopting this strategy.

One common myth is that it means sacrificing returns. However, research shows that sustainable investments often outperform traditional ones over time. Companies with strong sustainability practices tend to manage risks better, leading to more stable financial performance.

Another misconception is that this approach is only for the wealthy. In reality, there are various affordable investment options available, including funds and ETFs that cater to different budgets. Individuals at all income levels can participate in this movement.

Some also believe that investing sustainably is limited to specific sectors, like renewable energy. However, this is not true. Many industries, including technology and healthcare, have options available. Investors can find opportunities across different sectors that align with their values.

Lastly, many think that tracking the impacts of these investments is too complicated. Thankfully, numerous resources and platforms exist to help investors measure environmental and social impact, making it easier than ever to stay informed.

Future trends in sustainable investing

Future trends in sustainable investing are becoming increasingly significant. One major trend is the rise of impact investing. This approach aims to create measurable social and environmental benefits alongside financial returns. Investors are more focused on not just profitability, but also how their investments affect the world.

Another important trend is the increase in sustainable finance initiatives. Financial institutions are developing new products that meet sustainability criteria. These include green bonds and sustainability-linked loans, which encourage companies to improve their environmental practices.

Technology is also playing a key role in the future of sustainable investing. Advanced data analytics and AI are helping investors assess the sustainability of their portfolios more effectively. Tools that measure environmental, social, and governance (ESG) factors are becoming essential for making informed investment decisions.

Finally, as consumers become more environmentally conscious, demand for sustainable products is growing. This shift will likely lead to increased investment in sustainable companies, making this area more attractive for investors. As these trends continue to evolve, they will shape the future landscape of investing.

Embracing sustainable investing: a path to financial growth and positive impact

Sustainable investing is a growing movement that aligns financial goals with positive social and environmental impact.

The benefits of sustainable investing range from potential financial returns to the satisfaction of supporting ethical practices.

As we have explored, understanding how to start with sustainable investing is key.

By debunking common myths and keeping an eye on future trends, investors can position themselves for success.

Investing with sustainability in mind not only helps you grow your wealth but also contributes to a better world.

Therefore, consider integrating sustainable investment strategies into your portfolio and making a lasting impact.