Financial student loans can be a valuable resource for students aiming for higher education.

They provide the necessary funds for tuition, books, and other expenses that come with being a student.

With the right planning, these loans can set the stage for great opportunities down the road.

Many students worry about taking on debt, but understanding how loans work can ease those concerns.

Budgeting for your loans and living costs helps ensure that you can manage repayments later.

Knowing what you’re getting into can help you make smart choices about how much to borrow.

It’s also important to look into loan forgiveness options that may be available after graduation.

Some careers in public service offer programs to reduce your student loan debt.

Exploring these options can significantly reduce financial pressure and help you focus on starting your career.

Financial student loans can be a powerful tool for students seeking higher education.

They provide funds needed to cover tuition, books, and living expenses.

With the right financial aid, students can focus on their studies without the stress of financial burdens.

Choosing the right loan and understanding the terms is essential for all students. Many options are available from various lenders.

It’s crucial to research thoroughly to make the best decision.

Understanding Financial Student Loans

Understanding financial student loans is important for anyone looking to pursue higher education.

These loans provide money to cover costs like tuition, which can be very high.

Many students rely on these loans to help them get the education they need for their future careers.

There are different types of financial student loans, including federal and private options.

Federal loans usually have lower interest rates and more flexible repayment terms.

It’s vital for students to know which type fits their needs best to avoid financial stress later.

Before taking out a loan, students should carefully read the terms and conditions.

Knowing how much to borrow and what the repayment process looks like can help them stay on track.

Understanding these loans can truly unlock opportunities for success in their educational journey.

Types of Financial Student Loans

There are two main types of financial student loans: federal loans and private loans.

Federal loans are provided by the government and often offer better interest rates and repayment options.

These loans usually do not require a credit check, making them accessible for many students.

Private loans, on the other hand, come from banks or other financial institutions.

They may have higher interest rates and stricter credit requirements. It’s important for students to shop around and understand the terms before choosing a private loan.

Both federal and private loans can help students pay for their education.

However, students should carefully consider the differences and choose wisely to ensure they are making the best financial decision for their future.

How to Apply for Financial Student Loans

Applying for financial student loans can seem overwhelming, but it is a straightforward process.

Start by filling out the Free Application for Federal Student Aid (FAFSA).

This form helps determine your eligibility for federal loans and grants. Make sure to have your personal information and financial details ready when you apply.

Once you submit your FAFSA, you may receive a financial aid package from your school.

This package will outline the types of aid you qualify for, including federal student loans. Review your options carefully and choose the loans that best suit your needs.

If you decide to explore private loans, research different lenders and apply directly through their websites.

Be prepared to provide documents such as your credit score and income information.

Understanding the requirements for both federal and private loans makes the application process smoother.

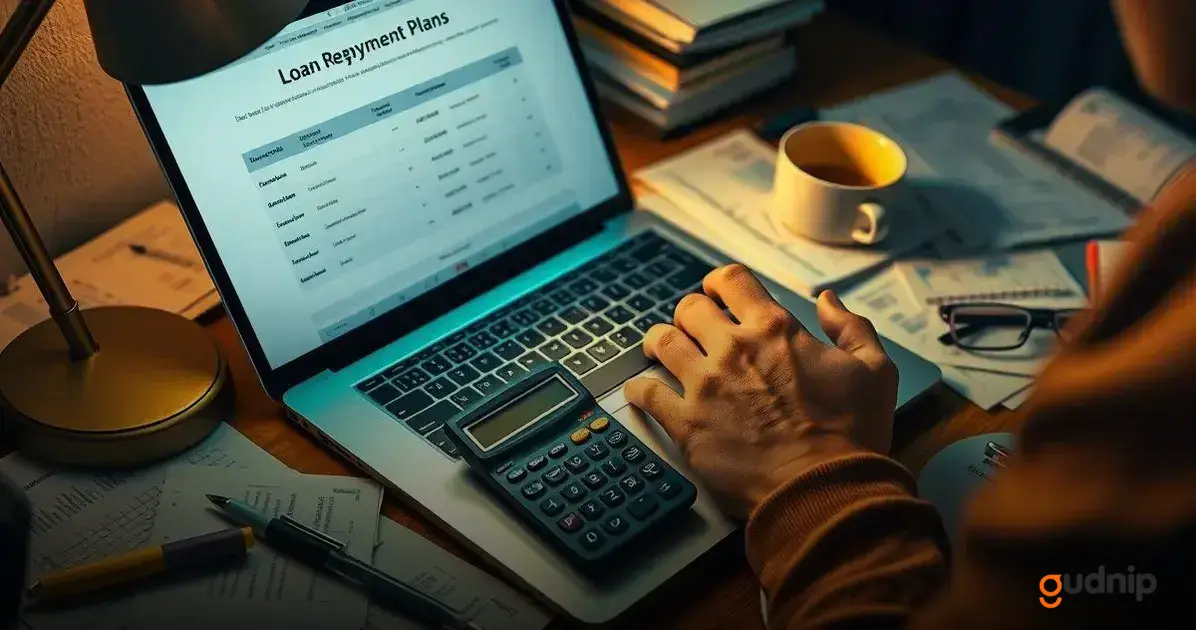

Repayment Options for Financial Student Loans

When it comes to repaying financial student loans, there are several options available to help borrowers manage their debt.

One of the most common repayment plans is the Standard Repayment Plan, which allows borrowers to pay a fixed amount each month for up to 10 years.

This plan is simple and often saves money on interest over time.

Another option is the Income-Driven Repayment Plan.

This plan adjusts monthly payments based on the borrower’s income, making it easier for those with lower salaries to afford their payments.

It can extend the repayment term, and after 20 to 25 years, any remaining balance may even be forgiven.

Additionally, borrowers might consider Loan Consolidation, which combines multiple loans into one.

This can simplify payments, but it’s important to review how it affects interest rates and benefits.

Understanding these repayment options can help borrowers make choices that align with their financial goals.

Common Myths About Financial Student Loans

There are many myths about financial student loans that can confuse students.

One common myth is that you can’t get any financial aid if your parents earn a lot of money.

In reality, financial aid is based on need, school costs, and other factors. Students whose families have higher incomes can still qualify for various types of aid.

Another myth is that taking out student loans will hurt your credit.

While it’s true that not repaying loans can damage your credit score, responsibly managing your loans can actually help build a positive credit history.

Making consistent payments on time is key to maintaining good credit.

Some people also believe that all student loans must be repaid immediately after graduation.

However, many federal loans have a grace period that allows you some time before payments start.

Understanding these myths can help students make informed decisions about their financial future with confidence.

Tips for Managing Financial Student Loans

Managing financial student loans effectively can make a big difference in your future.

One important tip is to create a budget that includes your loan payments.

Knowing how much you need to save each month can help you avoid missing payments and reduce stress.

Another helpful tip is to communicate with your loan servicer. If you face financial challenges, reach out to them right away.

They can offer options like income-driven repayment plans or deferment that may ease your burden during tough times.

Finally, consider making extra payments when possible.

Paying a little more than the minimum can help you pay off your loans faster and save on interest. Small, extra payments can add up over time and free you from debt sooner.

Future of Financial Student Loans

The future of financial student loans is likely to change as education and technology evolve.

More schools are using data analytics to offer personalized loan options based on a student’s financial situation.

This can help students find loans that work best for them, making funding more accessible.

We may also see a shift towards more flexible repayment options. Many lenders are realizing that students need varying plans depending on their job situation.

New options could include payment plans based on income or industry, aiming to ease stress and promote timely payments.

As awareness of student debt grows, there may also be efforts to increase loan forgiveness programs.

These programs could help graduates in public service and other important fields reduce their debt.

This allows them to focus on their careers and community impact rather than financial struggles.

Financial Student Loans

What are financial student loans?

Financial student loans can help open doors to a brighter future by providing funding necessary for students to attend college.

Why is understanding loan terms important?

When students understand the terms of their loans, they can plan for their financial future effectively.

How can managing debt wisely benefit students?

Managing debt wisely involves knowing how much to borrow and what the repayment will look like, which prepares students for their finances after graduation.

What role do grants and scholarships play in funding education?

Grants and scholarships can reduce the amount students need to borrow, easing the path toward financial stability.

How can combining loans with other funding sources help?

Combining loans with other funding sources can lead to a more manageable debt situation in the long run.