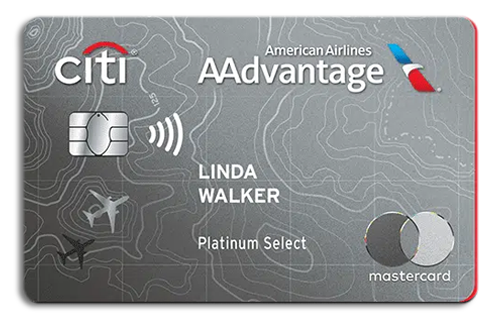

The Citi AAdvantage Platinum is the ideal companion for those looking to make the most of their purchases. With a set of benefits that go beyond the conventional, this card stands out by providing a practical payment experience filled with advantages.

Whether on a business trip or everyday purchases, this card offers flexibility and convenience. Moreover, it’s designed to make your transactions and purchases more secure and efficient, all while you accumulate AAdvantage miles.

If you’re tired of credit cards that offer nothing beyond the basics, this option offered by Citibank will surprise you. Keep reading and discover the benefits offered!

About the Issuer

The Citi AAdvantage Platinum is issued by Citibank, one of the largest financial institutions in the world. With extensive experience in the market, Citibank is recognized for its reliability and innovation in banking services.

Additionally, Citibank is known for its strategic partnerships, such as with American Airlines, ensuring Citi AAdvantage Platinum users access to a wide range of exclusive benefits and rewards.

The security and trust offered by Citibank are unmatched, making the Citi AAdvantage Platinum a card you can use worry-free anywhere in the world.

Benefits

AAdvantage Miles: With the Citi AAdvantage Platinum, earn 2 miles per dollar spent on gas stations, restaurants, and eligible American Airlines purchases, and 1 mile per dollar on all other purchases.

Priority Boarding: Enjoy priority boarding on American Airlines flights, ensuring overhead bin space for your carry-on and a smoother travel experience.

In-flight Purchases Discount: Save 25% on food and beverage purchases onboard American Airlines flights.

International: The card is accepted domestically and internationally thanks to the Mastercard brand, providing customers with much more freedom when making purchases.

Bonus Miles: Earn 50,000 bonus miles when you spend $2,500 on purchases within the first 3 months of account opening.

Citi AAdvantage Platinum – Fees and commissions

The Citi AAdvantage Platinum card has a fee and commission structure that should be considered before applying. The annual fee is $99, which is waived in the first year.

Interest rates vary according to your credit, usually between 21.24% to 29.99% APR (Annual Percentage Rate). For cash advances, the rate is 29.99% APR, plus a fee of $10 or 5% of the advance amount, whichever is greater.

Additionally, there’s a minimum foreign transaction fee of $0.50 for purchases made outside the US. Late payments are subject to a variable APR of 29.99%, the same applies to a returned payment.

Card limit

The credit limit of the Citi AAdvantage Platinum card varies based on the applicant’s credit analysis. New cardholders can expect initial limits that depend on factors such as credit history, income, and other financial criteria evaluated by Citibank.

Users with excellent credit history may receive even higher limits, while those with limited credit or more recent history may receive lower limits.

It’s important to remember that responsible credit management, including timely payments and maintaining a low credit utilization ratio, can lead to credit limit increases over time.

Positive points

- WIDESPREAD ACCEPTANCE:With the Mastercard logo, you can shop in hundreds of countries.

- TRAVEL BENEFITS:Includes travel insurance and emergency assistance during trips.

- MILEAGE ACCUMULATION:Offers attractive bonuses for new customers upon reaching certain spending thresholds in the first few months.

Negative points

- ANNUAL FEE:Despite being waived in the first year, the $99 annual fee can be a downside.

- FOREIGN TRANSACTION FEES:The fee for international transactions may deter frequent travelers abroad.

- ELIGIBILITY:Eligibility criteria can be stringent.

How to apply for Citi AAdvantage Platinum

Applying for the Citi AAdvantage Platinum credit card is a simple process and can be done online. Here are the steps:

- Go to the official Citibank website;

- Look for the Citi AAdvantage Platinum card;

- Click on “Apply now”;

- Enter your personal, financial, and contact information in the blank fields. Complete this step carefully to avoid errors;

- Next, read the card terms and agree to them;

- Review the information provided;

- Click on “Agree and Submit”;

- Wait for your application to be reviewed. If approved, you will receive the card at your address.

How to contact Citibank

For more information or assistance, you can contact Citi through the following channels:

- Phone: Call customer service at 1-800-950-5114;

- Branches: Visit a nearby Citi branch.

Ready to take off with the Citi AAdvantage Platinum? Enjoy all the exclusive benefits and make your purchases even more enjoyable and rewarding. Don’t waste time and apply for your card now to start accumulating miles!