Investing wisely is essential for building wealth, and one of the best strategies is to understand your financial goals.

Whether you’re saving for retirement, a house, or education, having clear objectives can guide your investment choices.

It’s crucial to know how much money you want to grow and by when, as this will influence the types of investments you pursue.

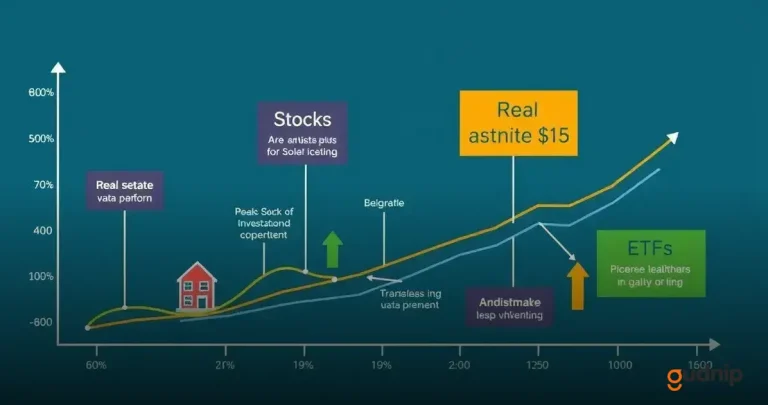

Diversifying your investments is another important strategy.

By spreading your money across different asset classes like stocks, bonds, and real estate, you can reduce risk.

If one investment doesn’t perform well, others may do better, balancing out your overall portfolio.

This mix helps protect your money and can lead to steadier growth over time.

Finally, regularly monitoring your investments will help you stay on track.

The market can change quickly, so being proactive allows you to make adjustments as needed.

Checking your portfolio often will help you understand what’s working and what isn’t, leading to smarter decisions that can unlock your wealth.

Best investment strategies are essential for anyone looking to build wealth and secure a stable financial future.

By understanding various options and methods, you can make informed choices that lead to greater financial success.

Understanding Investment Strategies

Understanding investment strategies is important for anyone wanting to grow their money wisely.

These strategies are plans that help you decide how and where to invest your money.

Each strategy has its way of balancing risk and reward, making it possible for you to choose one that fits your goals.

There are many different types of investment strategies.

For example, some people prefer a buy and hold approach, where they purchase stocks or real estate and keep them for a long time.

Others might choose a growth strategy, focusing on investments that will increase in value quickly. Knowing your own goals will help you pick the right strategy.

By learning about different investment strategies, you can feel more confident in your choices.

A good understanding allows you to make smart financial decisions and unlock your wealth over time.

You can combine different strategies to create a mix that works best for your financial future.

The Importance of Diversification

The importance of diversification in investing cannot be overstated.

Diversification means spreading your money across different types of investments, like stocks, bonds, and real estate.

This way, if one investment does poorly, the others can still perform well, helping you avoid big losses.

By diversifying your portfolio, you reduce the risk associated with relying too heavily on one investment.

For example, if you only invest in technology stocks and the tech market drops, your savings could take a big hit.

In contrast, a diversified portfolio may include investments in healthcare, energy, and consumer goods, balancing out the ups and downs.

Ultimately, diversification is a key strategy to unlock wealth over time.

It helps create a stable investment environment, making it easier to reach your financial goals.

By understanding the importance of spreading your investments, you can make smart decisions for a brighter financial future.

Long-Term vs Short-Term Investments

When it comes to investing, understanding long-term and short-term investments is crucial.

Long-term investments are typically held for many years, allowing your money to grow with the market.

This strategy is great for building wealth over time, as it can take advantage of compound interest and overall market growth.

On the other hand, short-term investments are usually made for quick returns, often held for less than a year.

This can include trading stocks or investing in bonds that mature quickly.

While you can see faster results, short-term investments also come with higher risks, making them a less stable option for accumulating wealth.

Choosing between long-term and short-term investments depends on your financial goals and risk tolerance.

If you want steady growth and can wait, long-term strategies might be your best bet.

However, if you are looking for quick gains and are willing to take more risks, short-term options could be appealing.

Understanding these differences will help you make informed financial decisions.

Top Investment Strategies for Beginners

If you’re a beginner looking to start investing, it’s important to know the top investment strategies that can help you build wealth over time.

One effective approach is to start with index funds.

These funds track a specific market index, allowing you to invest in a broad range of stocks without needing to pick individual winners.

This helps reduce risk while giving you exposure to the stock market’s overall growth.

Another great strategy for beginners is dollar-cost averaging.

This means investing a fixed amount of money at regular intervals, regardless of market conditions.

This approach can help you avoid the stress of trying to time the market and can lower the average cost of your investments over time.

Also, consider setting up an emergency fund before diving fully into investments.

Having three to six months’ worth of expenses saved can give you the peace of mind to invest without the worry of immediate financial setbacks.

By combining these strategies, you can create a solid foundation for a successful investment journey.

Real Estate Investment Tips

Investing in real estate can be a smart way to grow your wealth, but it’s essential to have some good tips in mind.

First, always do your research before purchasing a property. Look at the neighborhood, market trends, and potential rental income.

Knowing these factors will help you make an informed decision and avoid costly mistakes.

Another important tip is to consider property management.

If you’re buying rental properties, think about whether you want to manage them yourself or hire a property management company.

Managing tenants, maintenance, and finances can be time-consuming, so hiring professionals can save you stress and time.

Lastly, remember that location matters. Look for properties in areas with good schools, access to public transportation, and future development plans.

These features will make your investments more desirable, leading to higher property values and increased rental income over time.

Investing in Stocks for Growth

Investing in stocks for growth can be a great way to build wealth over time.

Growth stocks are shares from companies that are expected to grow at a faster rate than the market.

These companies often reinvest their profits to expand and develop new products.

By investing in these types of stocks, you have the potential to earn higher returns than more conservative investments.

To find good growth stocks, it’s important to research companies thoroughly.

Look for businesses that have a strong track record of increasing sales and profits.

Pay attention to their future plans and whether they are in industries that are expanding.

This kind of research can help you identify stocks that are likely to experience rapid growth.

It’s also wise to diversify your growth stock investments. This means spreading your money across different companies and sectors.

By not putting all your eggs in one basket, you can reduce the risk of losing money if one stock doesn’t perform well.

Remember, successful investing takes patience and learning, so stay informed and engaged with your investments.

Utilizing ETFs for Portfolio Balance

Utilizing ETFs, or exchange-traded funds, is a smart way to achieve balance in your investment portfolio.

ETFs are collections of stocks, bonds, or other assets that trade like stocks on an exchange.

They allow you to invest in a broad range of assets, which helps spread out risk and can lead to more stable returns.

One of the best things about ETFs is that they offer instant diversification.

By buying a single ETF, you can own a variety of different companies or sectors.

This means if one stock performs poorly, others in the ETF may perform well, balancing your overall investment.

This is especially helpful for new investors who may not have the time or knowledge to pick individual stocks.

When building a balanced portfolio with ETFs, it’s important to choose funds that match your financial goals and risk level.

Look for ETFs that focus on different areas, such as stocks, bonds, or even international markets.

By including a mix of these investments, you can create a well-rounded portfolio that helps you work towards your long-term financial goals.

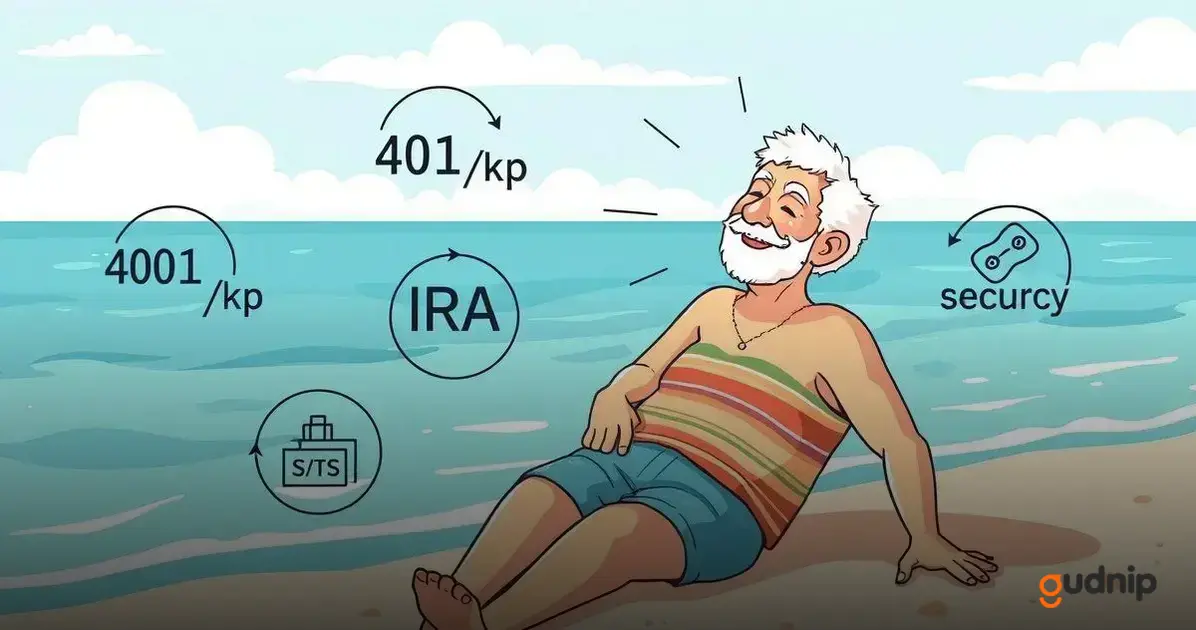

Retirement Investment Strategies

Having a solid plan for retirement is key to enjoying your golden years.

One of the best retirement investment strategies is to contribute regularly to retirement accounts like 401(k)s or IRAs.

These accounts often come with tax benefits, making your investment grow faster over time.

The earlier you start saving, the more you can benefit from compound interest.

Diversification is also crucial when planning for retirement.

This means spreading your investments across different asset classes, like stocks, bonds, and real estate.

By diversifying, you can reduce risk and improve your chances of achieving stable growth.

Remember, your investment choices may change as you get closer to retirement, so it’s important to adjust your portfolio to protect your savings.

Lastly, consider how much risk you’re willing to take based on your retirement timeline.

If you have many years before retiring, you might be able to take on more risk for higher potential gains.

However, as you get closer to retirement, it’s usually a good idea to shift towards more stable investments, which can provide security during your retirement years.

Building the right strategy today will help ensure a comfortable lifestyle tomorrow.

Analyzing Risk and Reward in Investments

When it comes to investing, understanding risk and reward is key to making smart financial decisions.

]Risk refers to the chance that you could lose money on your investment, while reward is the potential profit you could gain.

It’s essential to analyze how much risk you’re willing to take and what kind of rewards you expect in return.

Higher rewards often come with higher risks.

For example, investing in stocks can lead to significant gains, but it also means that the value of your investments can drop quickly.

On the other hand, safer investments, like bonds or savings accounts, may offer lower returns but come with less risk.

Analyzing these factors will help you determine which investment options align with your financial goals and risk tolerance.

To make informed choices, you should regularly assess your investments.

Look at how your portfolio is performing and whether the risks are still acceptable based on your goals.

By staying aware of market changes and understanding the relationship between risk and reward, you can adjust your investment strategy to better suit your needs.

Investing in the stock market can seem daunting, but it is a central part of making smart financial decisions.

One of the first things to understand is how to analyze a company’s performance. Look at key factors like earnings reports, revenue growth, and market trends.

These elements help you gauge whether a stock is worth investing in and how it may perform in the future.

Another important aspect is to stay informed about the industries you’re investing in. Different sectors react differently to economic changes.

For instance, technology stocks might rise when innovation is booming, while utility stocks may hold steady during economic downturns.

Being knowledgeable about these trends will allow you to adjust your portfolio and maximize returns.

Lastly, patience is crucial in investing. Many successful investors hold onto their stocks for the long term, even when short-term fluctuations occur.

This strategy allows for capitalizing on growth over time.

Always remember that investing is a journey, and staying informed will help you make the best decisions that align with your goals.