Alternative real estate niches are changing the property game. Investors are discovering unique opportunities beyond traditional markets. Creative thinkers often find profit where others see challenges.

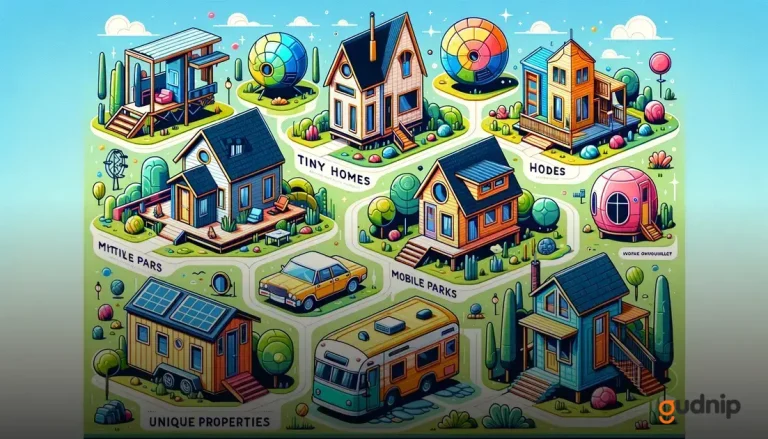

From tiny homes to mobile park investments, these niches offer potential for great returns. Many investors are successfully tapping into these less-explored areas.

Curious about which niches could be your next investment? Keep reading to discover valuable insights!

Understanding Alternative Real Estate Niches

Understanding alternative real estate niches is important for savvy investors. These niches represent unique markets outside of traditional real estate, such as vacation rentals or mobile home parks. Recognizing these opportunities can lead to profitable investments.

Many investors overlook these alternatives because they focus solely on typical properties like single-family homes. However, alternative niches can offer benefits like lower competition and higher returns. By exploring these areas, you might find the perfect investment that suits your goals.

Researching different markets is key to understanding these niches. Start by identifying trends and demands in your area. The more you learn, the better positioned you will be to take advantage of emerging opportunities.

Benefits of Investing in Alternative Niches

Investing in alternative niches can offer many benefits to real estate investors. One major advantage is the potential for higher returns. Unlike traditional properties, alternative niches often have less competition, allowing savvy investors to find great deals and maximize their profits.

Another benefit is diversification. By investing in different types of real estate, such as tiny houses or vacation rentals, you can spread your risk. If one area doesn’t perform well, others may still succeed, balancing out your overall investment portfolio.

Finally, alternative niches can provide unique opportunities for creativity and innovation. Investors can tap into new trends and lifestyle changes, attracting tenants or buyers looking for something different. This makes investing in these niches not just smart, but exciting.

Top 5 Alternative Real Estate Niches

There are many exciting alternative real estate niches to explore. One top option is vacation rentals. These properties can attract travelers looking for unique experiences. With platforms like Airbnb and Vrbo, homeowners can easily tap into this market, often earning more than traditional renting.

Another great niche is tiny homes. As people seek affordable and sustainable living, tiny homes have gained popularity. Investing in this trend can cater to eco-conscious buyers and renters looking to downsize while enjoying lower living costs.

Mobile home parks are also worth considering. They often have lower operational costs and can provide steady cash flow. With more people seeking affordable housing, investing in mobile home parks can be a smart long-term strategy.

How to Research Alternative Niches

Researching alternative niches starts with understanding your local market. Check out local listings and see what types of properties are renting or selling quickly. Websites like Zillow or Realtor.com can provide valuable insights into market trends and demands.

Next, explore social media and community groups. Platforms like Facebook and Instagram often showcase upcoming trends in real estate. Joining local groups can give you firsthand updates and opinions from other investors and residents interested in alternative living.

Lastly, consider attending real estate networking events and seminars. These gatherings are a great way to meet experienced investors who can share their tips and advice. Learning from those who are already successful in alternative niches will help guide you in your research efforts.

Investment Strategies for Alternative Real Estate

When investing in alternative real estate, it’s important to first assess your financial goals. Determine how much capital you can invest and what kind of return you expect. This will help you choose the right niche that aligns with your market and investment capabilities.

Diversification is another key strategy. Instead of putting all your money into one type of alternative real estate, consider investing in a mix. For example, along with vacation rentals, you might explore tiny homes and mobile home parks. This spreads out your risk and increases your chances for success in different markets.

Finally, don’t forget about ongoing research and adaptability. The real estate market can change quickly, especially in niche sectors. Staying informed about trends and being willing to adjust your strategies will help you stay ahead of the competition and make smarter investment choices.

Risks Involved with Alternative Real Estate

Investing in alternative real estate comes with its own set of risks. One major concern is market volatility. While niche markets can be profitable, they can also be affected by trends that change quickly. If the popularity of a specific niche declines, property values may drop, impacting your investment.

Another risk is related to tenant turnover. Alternative properties, like vacation rentals, often have higher vacancy rates compared to traditional rentals. This means you might face challenges when trying to find renters, which can lead to lost income during off-peak seasons.

Lastly, regulations can also pose a risk. Many alternative housing types, such as tiny homes or mobile home parks, might face stricter zoning laws or community rules. Keeping updated with local regulations is essential to avoid fines or issues that could hinder your investment.

Case Studies in Alternative Niches

One successful case in the world of alternative real estate is the rise of tiny homes. A couple in California turned a 200-square-foot space into a beautiful and functional tiny house. Their investment cost was low, but they quickly began earning income by renting it out on short-term rental platforms. This success story shows how tiny homes can attract renters looking for unique stays.

Another interesting case involves mobile home parks. An investor purchased an existing mobile home park and focused on upgrading the facilities and improving tenant relations. By offering better services and maintaining the park well, they increased both tenant satisfaction and rental prices. Their efforts led to a significant boost in overall property value.

Vacation rentals also present great success stories. An investor in Florida acquired multiple properties in popular tourist areas. By using smart marketing strategies and providing excellent customer service, this investor turned high occupancy rates into healthy profits. Their experience highlights the demand for quality vacation rentals in sought-after locations.

Future Trends in Alternative Real Estate

The future of alternative real estate is likely to be shaped by sustainability. Investors are focusing more on eco-friendly housing solutions.

Tiny homes and energy-efficient buildings are gaining popularity among buyers who care about the environment. This trend shows that sustainable living will play a key role in shaping the real estate market.

Another emerging trend is digital transformation in property management. Smart home technology is becoming more accessible, allowing property owners to manage their assets more efficiently.

Features like automated controls and energy monitoring systems not only attract renters but also increase value, making properties more appealing.

Lastly, as remote work continues to influence lifestyles, alternative real estate markets will evolve. More people are seeking homes in less urban areas or unique spaces like cabins or beach houses that allow for flexible living.

This trend suggests a shift toward leisure-focused investments in real estate, opening new opportunities for investors in alternative niches.

Getting Started with Alternative Real Estate Investments

Getting started with alternative real estate investments begins with research. Take time to learn about different niches, such as tiny homes, vacation rentals, or mobile home parks. Understanding the demand and potential returns in your chosen niche will help you make informed decisions.

Next, set a specific budget for your investment. Consider how much money you can invest and whether you’ll need financing. Creating a clear budget allows you to narrow down your options and focus on properties that fit within your financial plan.

Finally, connect with other investors or mentors in the field. Networking can provide valuable insights and support as you navigate the alternative real estate market. Joining online forums or attending local real estate events can open doors to new opportunities and help you learn from others’ experiences.